EPLF market study 2011 confirms: Laminate flooring is the consumers’ favorite

18 January 2012

There is a large selection of floor coverings on the market and new types of floors are constantly added. In this context, EPLF recently employed a market study to examine the position of laminate flooring in this offer portfolio. Against this backdrop, the association worked in cooperation with Deutsche Messe AG, organiser of the Woodflooring Summit at Domotex. The study reveals what is indicated by the 2011 sales figures: Laminate flooring was and is popular among consumers in Germany, France and Poland. The study was conducted on these three important European core markets. Laminate flooring is not as popular among architects as it is with the consumers, but it has significantly gained acceptance with increased levels of information.

The market study generally surveyed consumers who have bought new floors in the previous year or are planning to buy new floors in the next months. The architects who participated in the study all have diverse experience in hotel and restaurant contract business, the shop-fitting industry, as well as private flat and office construction.

The decision-making process of buying floor coverings requires a relatively long time period of four to five months – time for manufacturers and the trade to actively influence the process. In couples, men and women often make the decision of buying floor coverings together. For laminate flooring in particular, women are at the helm in Germany and France, while more men decide to purchase laminate flooring in Poland. In all three countries, customers mainly buy laminate in DIY stores; especially in Germany, however, specialised stores follow closely. In Poland, there are also so-called markets for flat and home design that are strongly frequented for the purchase of floor coverings.

Before the purchase, two sources of information are particularly important to consumers in all three countries: Looking at floors at the homes of friends and acquaintances and speaking to friends and acquaintances. Conversations with sales people, craftsmen, or the product exhibition in hardware or specialised stores are ranked lower. Internet-based sources of information are significantly less important, also for consumers younger than the mid-forty range. Architects in Germany and France primarily gain information using original samples and sample folders, while reference objects play an important role in Poland, as well as conversations with colleagues, planners and interior designers. Interestingly, in all three countries, architects feel more strongly that they are fully informed about the offers on the flooring market than consumers.

Strengths of laminate: Design, installation, durability

An appealing design, simple maintenance, durability and an appropriate price-performance-ratio are the primary customer requirements for floors. For architects, individual design possibilities, hygiene, manufacturer warranty, possibility of large-scale installation and suitability for under-floor heating play important roles in addition to a good price-performance-ratio. Consumers and architects agree that the strengths of laminate flooring in particular include its appealing design, simple installation, durability and price-ratio-performance. The ranking of floor requirements is rather similar in Germany, France and Poland among both target groups. However, the consumers have the highest level of requirements in Poland, while this applies to architects in Germany.

In comparison to other floor coverings, laminate floors were rated highly by consumers. Compared to resilient floor coverings, laminate particularly scored with the characteristics “elegant/sophisticated, insulating properties and ecological soundness“, compared to carpets with the characteristics “hygienic, damaged parts can be replaced and suited for under-floor heating“, compared to parquet with “do-it-yourself- installation“, compared to tiles with “heat and noise insulating“ and “slip-resistant“. Architects, however, have a more critical attitude toward laminate flooring, especially in Germany. In France, laminate scores higher among architects in comparison to resilient floor coverings in “ecological soundness“, compared to parquet in “price-performance ratio, hygiene and machine cleaning” and compared to tiles with “sound insulating and slip-resistant”. Polish architects prefer laminate to tiles due to the above-mentioned characteristics, however, they do not prefer it to parquet.

Price tolerances in Germany, France and Poland

The price tolerance for high-quality laminate floors ranges between 12 and 20 EUR per square meter for German and French consumers and from 10 to 15 EUR for Polish consumers. The surveyed persons’ income and level of information about laminate flooring must be taken into account. Interestingly, price estimates increase with lower levels of information. This could be interpreted as an expression of lacking knowledge about the actual prices. In higher income classes, surveyed persons are willing to spend up to 25 EUR per square meter for a high- quality product, while prices below five Euros are seen as too cheap across all income ranges and associated with low-quality products.

EPLF appreciates the fact that quality awareness seems to exist among consumers and is reflected in their willingness to spend more money on laminate. This promotes the image of laminate flooring on the market and not only shows its popularity, but also increases its value on the market.

Enclosures

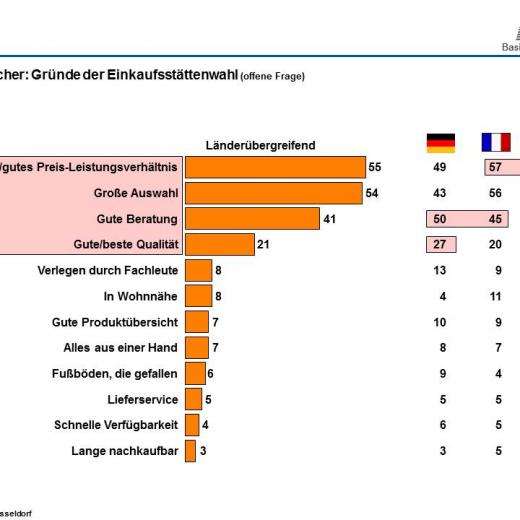

Chart 1: Consumers, Reasons for store selection

Chart 2: Consumers, Subjective importance of sources of information

Chart 3: Architects, Subjective importance of evaluation criteria

Chart 4: Consumers, Laminate flooring – Price estimate

Contact for press enquiries

Anne-Claude Martin

Press Officer

press(at)eplf.com

Rue Defacqz 52

B - 1050 Ixelles

Phone +32 2 788 31 68